Norway’s renewables exports to increase 8-fold by 2030

Norway’s renewable energy sector generates $1.2bn in export revenues today. My analysis of commitments by both private and state actors shows that that figure should rise 8-fold by 2030.

Norske selskaper bør ha mulighet til å øke sin produksjon i vind- og solenergi mye i årene fremover. Bildet er fra et anlegg Scatec har bygget i Rwanda. (Photo: Scatec Solar)

In December, the new report «Scandinavian Investment in Renewable Energy in Developing Countries» was presented at an Investor Forum hosted by The Norwegian Solar Energy Cluster. The report is authored by the two consultant companies Multiconsult and Differ, on behalf of the environment organization Zero, Norfund (Norway’s development investment fund) and the network organisation for the Norwegian solar sector.

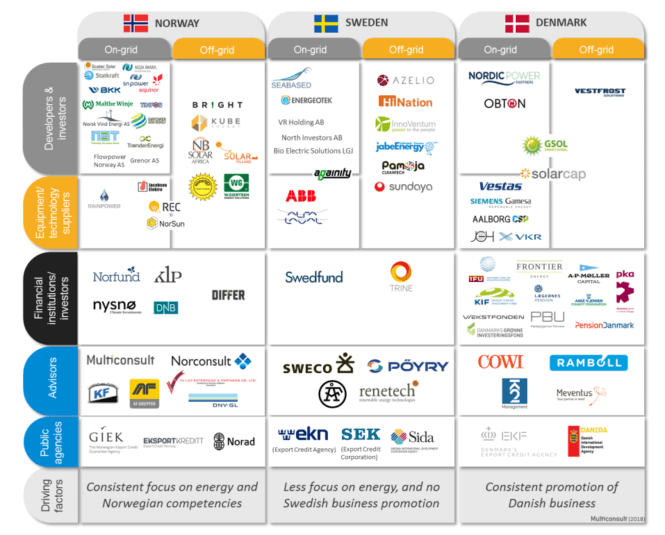

The report analyses how the level of private investments differ between Norway, Denmark and Sweden and looks at differences in publicly financed support mechanisms and instruments. One important finding in the report is the emergence of a sizeable and rapidly growing sector in Norway, and that the Norwegian business community has the largest number of developers and investors in commercial renewable energy projects in developing countries, compared to Denmark and Sweden. In addition to Statkraft, Scatec Solar and SN Power, the report also draws attention to Empower New Energy (where I am founder and CEO) as one of the emerging Norwegian players in the field.

Building on recently announced plans from the leading companies in the field, I estimate that the total international revenues from Norway’s solar and wind sector is set to grow exponentially to $8-9bn by 2030. This is an 8-fold increase from the estimated $1.2bn that Norwegian renewable energy generates in terms of export revenues today.

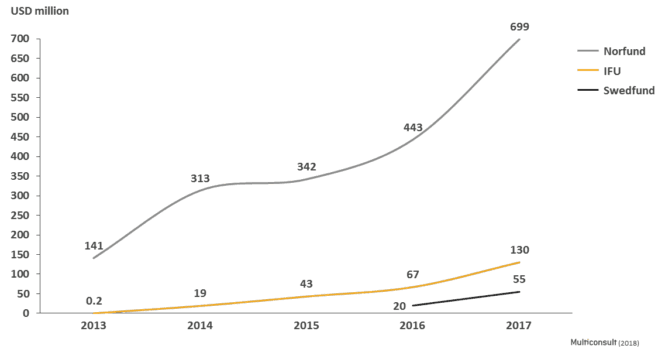

Norway’s renewables sector is increasing investments

The calculations are done based on ambitions recently announced by the leading Norwegian energy companies this year. Equinor, as a case in point, has announced that the investments into renewables and low-carbon energy shall increase to 15-20 percent of the company’s total investment budget by 2030. More than $15bn will be invested into solar and wind in the next ten years. Statkraft, the large utility company, has equally announced that they will invest about $7-8bn in wind and solar the next 8 years in Europe, Asia and Latin-America. They target 6 GW in wind and 2 GW in solar energy – with an assumption of continued growth until 2030.

Norway’s fast-growing international solar power provider Scatec Solar should more than double its installed capacity to 1.5 GW from 2018 to 2020, generating $150-200m a year in revenues. Given the company’s pipeline and growth strategy, I estimate that Scatec’s yearly revenues can increase to more than $600m before the end of the next decade.

In addition to the three large renewable energy companies mentioned, newcomers like Otovo and Empower New Energy are expected to grow considerably internationally in the next decade. All in all, I roughly assume that the group of «others», which includes these two companies, will double their export revenues by 2030, from about $1bn to $2bn.

In addition to the commercial investors, Norfund – already a large clean energy investor in emerging markets – and the new sovereign Norwegian Climate Investment fund are expected to scale up investments into international solar and wind considerably.

All in all, summing up the parts, I estimate that the announced growth in Norwegian commercial and non-commercial investments into international solar and wind in the coming years will result in yearly revenues of $7-9bn from 2030 onwards. This is almost at level with the total exports from the seafood industry, Norway’s second biggest export industry.

$9bn in renewables export revenues by 2030. Could Norway go further?

An 8-fold increase in revenues may sound ambitious to some, but it is worth noting that the comments at the industry-seminar was rather: Why not more? Dr. Alf Bjørseth, the legendary founder of REC, Norsun and Scatec Solar, said he believes the growth can be even more powerful, taking the vast opportunities into account.

Of course, the solar and wind investments will not be as labour intensive in Norway, as say, the seafood or the tourism industry. However, jobs in the renewable sector offer the kind of interaction between capital, know-how and passion for sustainable development that more and more people are attracted to. Additionally, when companies like Statkraft, Scatec Solar and Equinor as well as newcomers like Otovo and Empower invest heavily, you get a locomotive effect, indirectly resulting in a growing Norwegian cluster of companies serving the locomotive-companies with products and services.

Investment in developing nations: much more is needed

However, as also highlighted at the seminar, in a business-as-usual scenario the least developed economies will hardly benefit from the investment trends highlighted here. To make sure a larger share of Norway’s clean energy investments are channeled to the countries most in need of it, the kind of risk-sharing in the form of partial guarantees, or similar, outlined in the Multiconsult report are important. Our Minister for Development, Nikolai Astrup, has announced a doubling of Norway’s support to renewable energy in developing countries, and is reportedly studying the reports’ recommendations. The coming decade will be a period of vast opportunities for Norway’s emerging solar and wind sectors.