Will IEA and governments be the last to discover solar PV revolution?

The IEA’s outdated cost assumptions for solar energy influence opinion leaders and policy makers. They should be corrected.

Electrical apprentice Eric Penel works on the solar reference array, which has been installed on the roof of the Shaw Theatre at NAIT’s Main Campus in Edmonton.

It’s no surprise to the industry that the International Energy Agency’s World Energy Outlook is far off when it comes to solar PV, but so what? Does it really matter? I didn’t think so, but having discussed the matter with senior politicians and government officials quite a few times, I discovered that for mainstream opinion leaders and policy makers in the industry, IEA does really matter. But I wasn’t satisfied to know IEA was wrong, I wanted to know how they could be so wrong. So I decided to put other things aside for a few days, and dig into to the numbers. What I discovered was even more provoking than I thought, so I am glad the Norwegian Climate Foundation asked me to publish the report «IEA and Solar PV: Two Worlds Apart.»

Terje Osmundsen: «IEA and Solar PV: Two Worlds Apart» (pdf). Published by the Norwegian Climate Foundation, February 2014.

So what did I find?

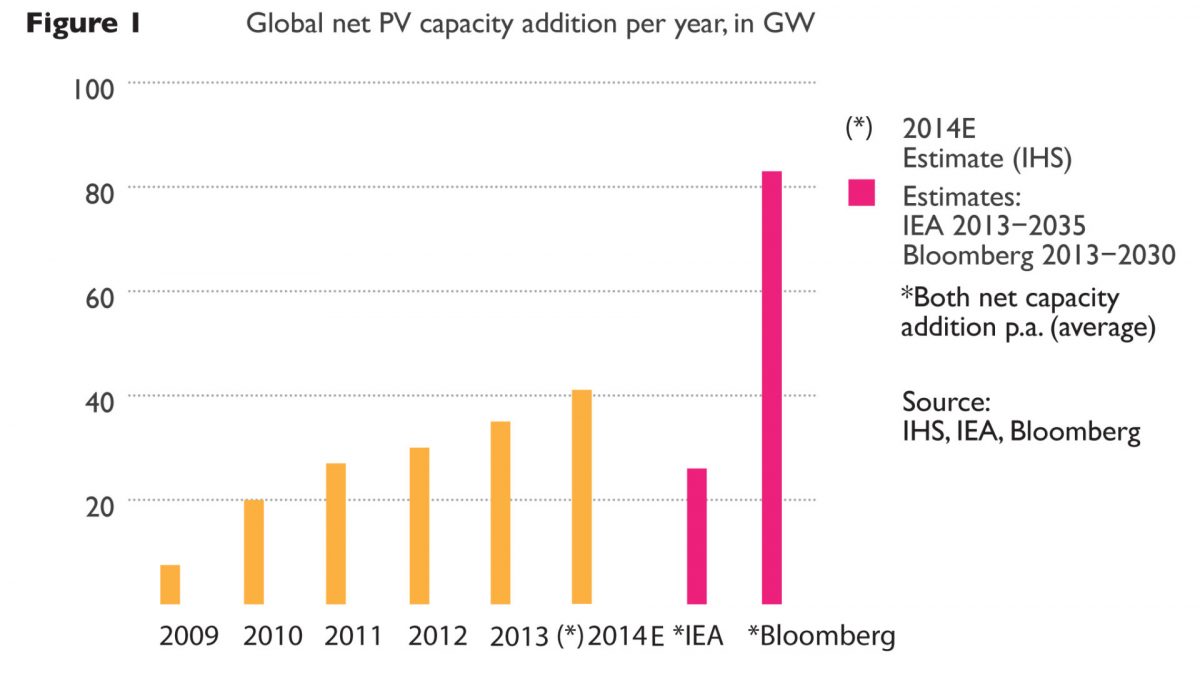

In its main scenario, the New Policies Scenario, one is surprised to discover that IEA predicts a flabbergasting slow-down at the time when most industry observers see solar PV increasingly competing against fossil fuel alternatives. After a period of 25% annual growth since 2010, yearly additional installation of PV is expected to pass 40 GW in 2014. But according to IEA, the growth will stop here, yearly average additions the next 23 years will be less than 26 GW, i.e. lower than in 2013. This is several times less than other market forecasts cited in the report. Bloomberg, for example, estimates that the average yearly net additions the next 17 year will be higher than 80 GW, more than three times more than predicted by IEA.

The main reason for this extreme conservatism is IEA’s far outdated cost assumptions.

They claim the average cost of PV electricity in the US and Europe is in the range 0,23-0,24 $/kWh, despite the fact that utilities these days sign Power Purchase Agreements with a tariff two times cheaper. In the US, the average negotiated tariff (inflation-adjusted) of large-scale solar PV fell to below 0.06 $/kWh in 2013, according to study by the National Laboratory of the U.S. Department of Energy (NREL 2012).

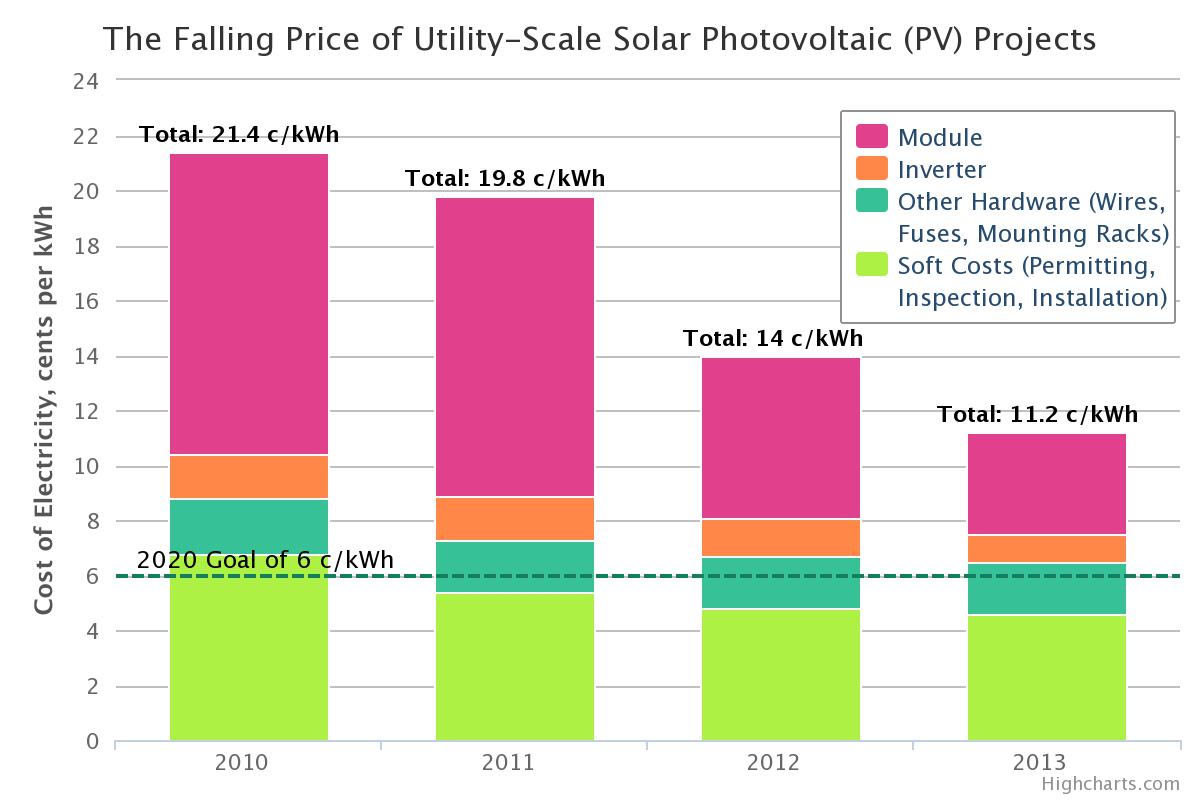

Last month the US Department of Energy published a progress report that sheds further light on the cost of building utility-scale solar PV in North America (see figure below). The estimated levelised cost of solar PV, a calculation method that corrects for the tax credit, fell from 0,22 $ in 2010 to 0,11 $/KWh in 2013.

In Europe, Fraunhofer Institute calculates that the levelised cost of PV from ground-mounted utility scale PV in Southern Germany fell to 0.11-0.14 $/kWh in 2013. In Southern Europe the cost is somewhat lower despite higher finance costs, 0.08-0.10 $/kWh, two and a half times less than the cost reported by IEA.

Looking at emerging markets, South Africa is an interesting case in point. In the first round of the new Renewable Energy Program tendered in 2011, the average tariff of the selected bids were close to 0.30 $/kWh. In the second round one year later, the tariff fell to below $0.20, and in the third round in 2013 the average tariff offered by the selected bidders came close to 0.10 $/kWh.

No surprise therefore, that even IEA’s moderate growth turns out to be extremely expensive.

According to the World Energy Outlook report, all solar PV generated between now and 2035 will receive on average 0.13 $/kWh in subsidies per year, a total subsidy equivalent to 1 600 billion US dollars for only 750 GW installed the coming 23 years. Presented with such a giant price tag, no wonder politicians, economists and lobbyists continue to claim that renewables are too expensive.

How can these grossly exaggerated cost projections and underestimated growth projections be explained?

Firstly, the model’s investment costs for large scale PV, between 2.5 and 3 dollar per watt in OECD, are severely overstated. According to Fraunhofer Institute the actual investment cost is ca 40% lower, 1-1.7 € (1.35-2.2 $) per watt.

Secondly, IEA believes the learning curve of the industry, i.e. the percentage cost reduction for every doubling of PV capacity, will decline to 18%, compared to 40% the last years. As a matter of comparison, the US «Sunshot» program – an innovation partnership between the Department of Energy, R&D laboratories and the industry – expects the investment cost of utility-scale PV will drop to 1-1.38 dollar per watt by 2020.

IEA report in the media

The author’s report on IEA and solar PV has been featured and quoted in news media and several energy/cleantech publications. See Clean Technica, Energy Post and RenewEconomy.

To make an independent judgment, it is important to realize that the PV industry is still in its infancy.

There is still a large potential for both process innovation and product innovation that will continue to drive prices down: Manufacturing the PV panels will become more resource-efficient and automated. The thickness of the wafers can be slashed, cutting the high cost of manufacturing. Cell design is continuously improved with new features, leading to higher yields and better resistance. Various research programs work to introduce nano-scale technologies; or to make the integration of multiple junctions («layers») into one cell commercial. With each new junction, the cell can then capture a much larger bandwidth of solar radiation.

Various reports support the view that costs will continue to fall. GTM Research estimates in a report of June 2013 that «production costs for industry-leading Chinese crystalline silicon (c-Si) PV module manufacturers will fall from 50 cents per watt in the fourth quarter of 2012 to 36 cents per watt by the end of 2017» (Greentech Solar 2013).

The solar panels now represent less than 50% of the investment cost of PV systems. The remaining share – the Balance-of-System – are inverters, structures, civil work, installation, transformers, cabling, etc. Also these costs have come down significantly the last years, and will continue to do so. Economies-of-scale and the fact that the size of inverters, structures, cables, etc fall as direct proportion of more efficient panels, are two predictable drivers. More importantly, new and existing players will continue to introduce smarter structures, trackers and installation technologies, as well as more efficient inverters and transformers.

Finally, assuming only 20 year lifetime for PV, IEA projects that 160 GW of solar power will be decommissioned by 2035. This is highly unlikely. Based on various studies experts today consider the long-term resilience of PV to be high (CAT 2014). Although the panel manufacturers’ performance guarantee expires after 25 years, PV plants will most probably continue to generate electricity for 30-40 years, if not more. Parts of the equipment will be replaced over time, but the very infrastructure of the solar plant remains.

From an Outlook with a time horizon to 2035, I would have expected a discussion on how the energy sector and societies as a whole could prepare for a situation some years ahead when solar PV has become the preferred and least expensive option of electricity generation in large parts of the world. Of course, the «system costs» related to a higher share of variable renewables, notably grid capacity and dispatchable or stored capacity to balance intermittent wind and solar, emphasized by IEA are important and will require significant investment and new business models. But reading the Outlook, I get the clear impression that IEA is more concerned about inconveniences of solar and wind, and less aware of the benefits.

Photovoltaic power is extremely reliable (practically no down-times) and seen from the system operator’s point of view it supports frequency stabilisation. Often produced closer to the users, it alleviates the pressure on the grid, and can be scaled up fast and easily to meet incremental growth in demand. Solar PV replaces health-threatening pollution and alleviates the heavy foreign exchange burden on fuel-importing countries. It creates employment in engineering, manufacturing, assembling, installation and operation and maintenance.

In the US for example, solar companies added close to 24 000 new jobs in 2013, of which 50% in installation. This is an increase of 20% in a year, ten times more than the national average for job growth (PV Magazine 2014).

IEA and IRENA should put their heads together. In January this year, the government-sponsored International Renewable Energy Agency (IRENA) published its first comprehensive REmap 2030, based on an in-depth review of 26 countries which account for 74% of projected global total final energy consumption in 2030 (IRENA 2014).

The IRENA Roadmap shows that the world can double the share of renewables as part of total energy consumption by 2030 at a limited substitution cost – in average 2.5 $ per gigajoule (GJ) – for the countries concerned. Taking externalities like health and cost of emitting CO₂ into account, the net savings for societies in doubling the share of renewables are estimated between 3-15 $ per GJ.

In addition, the REmap scenario will lead to an annual average of 900 000 additional direct jobs. In IRENA’s analysis, renewables are at least as important as energy efficiency in CO₂ reduction in potential terms, and their importance will only grow after 2030.

In the power sector, the IRENA roadmap projects a trajectory of renewables increasing from 18 to 44% of total generation by 2030. Not surprisingly, wind and solar PV will play the key role, increasing at least five- and twelvefold, adding about 70 and 60 GW, respectively, of new wind and PV capacity on average each year between today and 2030.

But perhaps more important: IRENA calculates that the average substitution costs for this twelve-fold increase of solar PV will be in the range of 2.5 $ per GJ. This equals around 8.5 $ per MWh – ca 7% of the «PV subsidy» calculated by IEA. Taking health and the costs of CO₂ emissions into account, IRENA estimates the savings related to replacing fossil fuels with renewables to be in the range 1.7-20 $ per GJ, or 6-70 $ per MWh.

IEA and IRENA are both international organizations with a mandate from governments to provide policy-relevant advice on how to speed up the required transformation to a low-carbon energy system. However, as shown in this report, IEA’s World Energy Outlook and IRENAs REmap are almost two worlds apart. Governments and stakeholders would be better served if the two organizations put their heads together, and published a joint study on the economics of and potential for renewables in the power sector.