Norwegian oil production and keeping global warming ‘well below 2°C’

Oil and gas production is a major part of Norway’s economy, accounting for 22% of its GDP and two thirds of its exports. Here you see Saipem 7000, the world’s second largest crane vessel, after the Thialf.

Many countries have adopted mitigation measures, including carbon pricing, to discourage fossil fuel use and support renewable and other low-carbon energy sources. However, those measures are not sufficient to meet the Paris goal. Indeed, under countries’ current commitments, global greenhouse gas (GHG) emissions are expected to continue to increase through 2040 and possibly beyond.

Moreover, investment in fossil fuel production is expected to grow even as countries seek to reduce fossil fuel consumption.That disconnect has led to questions about whether meeting climate goals will require constraining fossil fuel production as well as consumption.

The divide between climate goals and fossil fuel-sector investment is particularly evident in Norway. The country’s Intended Nationally Determined Contribution (INDC) under the Paris Agreement establishes a target of reducing domestic emissions by at least 40% from 1990 levels by 2030 and a “binding goal” of becoming a carbon-neutral “low emission society” by 2050.

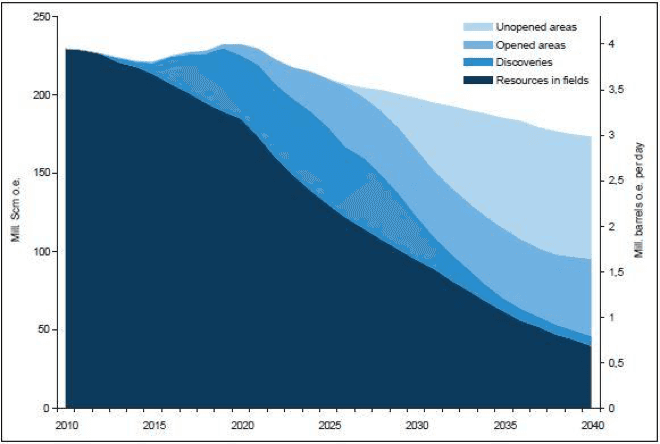

However, Norway also expects to continue producing significant volumes of oil and gas for decades. The Norwegian Petroleum Directorate (NPD) has stated that it will be possible to “maintain production from the [petroleum] sector at a very high level for decades to come”. Indeed, as illustrated in Figure 1, the Ministry of Petroleum and Energy and NPD have projected only a slight decline in oil and gas production through 2040.

Fossil fuel production now accounts for over a quarter of Norway’s domestic GHG emissions.Those emissions are covered by the European Union’s Emissions Trading System (EU ETS), so there are ways to offset continued emissions through deeper reductions elsewhere in the EU. Still, meeting Norway’s long-term goal of becoming a low-emission society will require steep emission reductions in the sector – either through reduced production or by lowering the emissions intensity of production.

Furthermore, fossil fuels produced in Norway and exported to other countries will still contribute to global GHG emissions when combusted. Several analyses have shown that when a country increases its oil production, the increase is not fully offset by reduced production elsewhere – and when global oil production increases, so do oil consumption and overall CO2emissions.

This briefing paper examines what a “well below-2°C” scenario might mean for future oil production in Norway. Such a scenario would clearly entail lower levels of global oil demand than under business as usual, which would likely cause oil prices to be lower as well.

We consider which oil resources would still proceed (or continue producing, if already developed) in this lower-price environment consistent with a 2°C climate scenario. Our analysis shows how policy-makers in Norway could apply a “climate test” – checking for consistency with a 2°C scenario – as part of the decision-making process on whether to open additional areas for drilling.

The Norwegian oil industry in context

Oil and gas production is a major part of Norway’s economy, accounting for 22% of its GDP and two thirds of its exports.Norway currently produces about 2% of the world’s oil supplyand exports about three quarters of that oil, almost all to EU countries. The Norwegian Petroleum Directorate expects about half of future production to occur in the North Sea and Norwegian Seawest of Norway and the other half to occur in the Barents Sea north of Norway.

Offshore areas in Norway are leased in two types of licensing rounds. Areas that have better-known geology and well-developed infrastructure are leased annually through Norway’s Awards in Pre-Defined Areas, or APA, scheme. Every other year, the government holds licensing rounds for still-unexplored frontier areas.

The NPD scenario for future oil and gas production in Figure 1 assumes that Norway “exploit[s] the entire resource base” by pursuing technologies to raise the resource recovery rate and by changing existing leasing and finance policies to increase industry investment. Given that Norway has recognized the urgency of reducing GHG emissions, however, it is crucial to ask how pursuing such a scenario might affect global emissions, and whether maintaining high levels of production for decades to come, as the NPD has advocated, is consistent with the 2°C goal.

To explore this question, we look at the relative break-even cost of oil production around the world consistent with a “well below” 2°C scenario, as articulated in the Paris Agreement. For this analysis, we assume that production will come from the lowest-cost resources, consistent with letting the market decide. In practice, other factors might also come into play in determining which oil resources are extracted or left in the ground – such as the equitable distribution of the resource extraction benefits, protection of environmentally sensitive areas, and energy security considerations. We discuss those considerations further below.

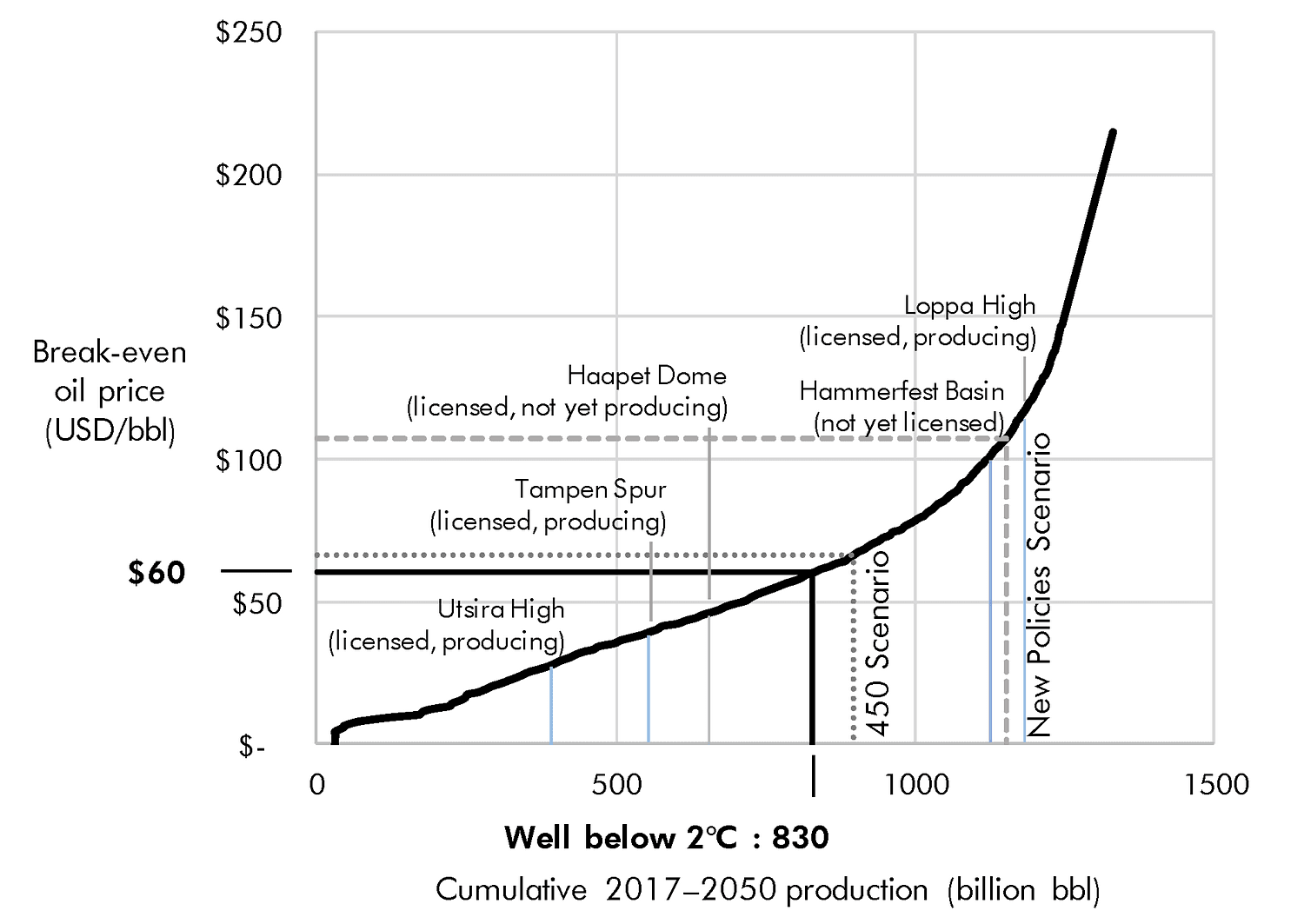

Our analysis requires two components: an estimate of cumulative global oil consumption in the chosen 2°C scenario and an assessment of the break-even cost of oil production (an oil cost curve). Our oil consumption estimate is based on the International Energy Agency’s (IEA) analysis of global oil production, by region, in a scenario designed to be consistent with the Paris goal to keep warming “well below 2°C”.We estimate this to be 830 billion barrels. (The “well below 2°C” scenario envisions somewhat less oil production than IEA’s longstanding 450 Scenario, which assumes a 50% chance of limiting warming to 2°C.) For the second part of our analysis, we use an oil production cost curve to identify the lowest-cost resources consistent with this 830 billion barrel global oil budget.

Figure 2 shows the results of the analysis. The global cost curve for oil production, drawn from Rystad Energy,orders oil resources from lowest-cost on the left to highest-cost on the right. The intersection between the cost curve and the oil consumption amount corresponding to IEA’s “well below 2°C” scenario, 830 billion barrels of oil, occurs at US$60 per barrel. Assuming well-functioning global markets, only resources with break-even oil prices less than $60 per barrel would proceed.

The break-even costs of several Norwegian oil resources are also shown in Figure 2. Some existing resources, such as Utsira High and Tampen Spur, would remain viable in a 2°C scenario with loweroil prices. However, higher-cost projects in some areas that have yet to be licensed, such as the Hammerfest Basin, as well as some existing projects, appear to require higher break-even oil prices, and therefore would not be economic in a “well below 2°C” scenario.

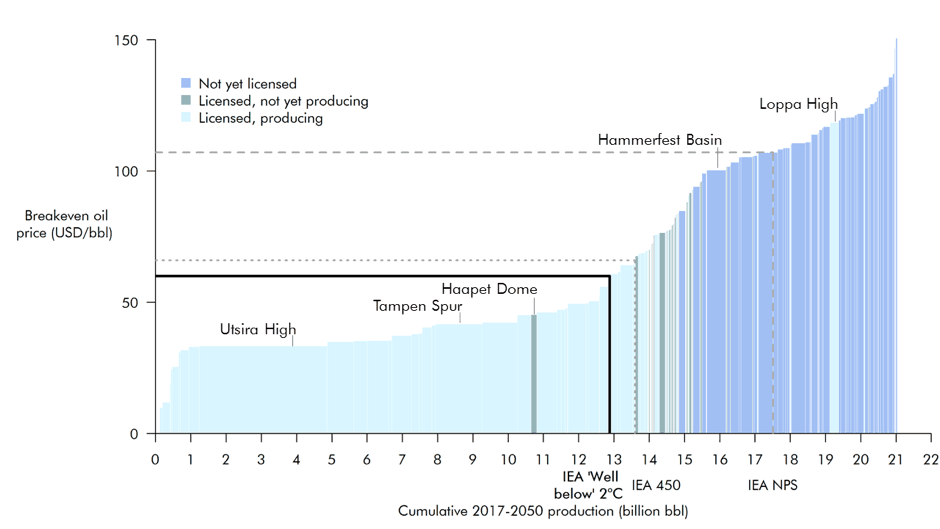

Assessing new Norwegian oil in a ‘well below 2°C’ scenario

To get a better sense of how Norwegian oil production compares to the “well below 2°C” and other scenarios depicted in Figure 2, Figure 3 shows the break-even prices of just Norwegian oil resources, with the same break-even price thresholds (e.g. US$60 per barrel) associated with the policy scenarios in Figure 2. As shown in Figure 3, most, if not all, of Norway’s offshore oil resources in areas not yet leased would not appear to “fit” within the oil production budget consistent with IEA’s “well below 2°C” scenario.

It is possible that companies could achieve break-even prices that differ from the estimates that we use here. This assessment is based on a cost curve produced by Rystad Energy, which provides estimates of break-even prices that its experts believe to be conservative, and higher than what “best in class” operators may be able to achieve.For example, the NPD reports that some projects have achieved substantial reductions in break-even prices.The uncertainty around true break-even oil prices suggests that further analysis may be helpful to assess whether individual projects are economically consistent with a 2°C scenario.

On the other hand, some cost savings, such as technological improvements, would be available to operators globally, not just in Norway. That means that applying the economic approach used here, cost savings achieved on all projects globally would not change the relative cost-effectiveness of resources, nor would they change which resources would fit within a given oil consumption budget.

It could be argued that Norwegian oil producers are better positioned than others to operate under climate constraints. The GHG emissions associated with production of each barrel of Norwegian oil tend to be lower than those for oil produced in other parts of the world, and Norway already imposes a carbon price of about US$50 per tonne of CO2from petroleum production.However,the GHG emissions associated with producing a barrel of oil are typically 5% to 25% of the emissions associated with the combustion of that barrel of oil,depending on the source, and represent a relatively small component of the oil’s emissions impact.

Furthermore, there would have to be a very high price on carbon applied globally for Norwegian oil to gain a strong advantage in a low-carbon world. For example, if a price of US$50 per tonne of CO2emitted from production were applied globally, it would add only US$1–5 per barrel to the cost of most oil produced outside of Norway,which is small compared with the range of costs in Figure 3. Thus, based on our analysis, it appears that licensing new areas for oil production in Norway would not be consistent with a scenario that keeps global warming “well below 2°C”.

If, nonetheless, oil production continues to expand in Norway, the question would be what other resources globally can be left undeveloped to keep overall GHG emissions consistent with a “well below 2°C” pathway. Here, we have used a market-based approach to determine what oil should be produced, but there are other potential considerations, such as energy security, equity, and availability of alterative development pathways.

Since Norway is a wealthy country with a high standard of livingand a well-funded sovereign wealth fund,it likely faces fewer barriers in transitioning away from a fossil fuel production than many other nations. Thus, in a scenario for global fossil fuel production that took development needs and alternative revenue sources into consideration, Norway’s share of future oil and gas production would likely be smaller than under a market-based approach.

Conclusion

Limiting warming to within 2°C will require a rapid phase-out of fossil fuel use over the coming decades. Many countries, including Norway, have focused on reducing demand for fossil fuels, but those efforts have not been enough to stop the rise in global greenhouse gas emissions. Measures to constrain fossil fuel supply can complement demand-side efforts and help accelerate progress towards the 2°C goal.

For Norway, there are two compelling reasons to embrace supply-side climate strategies. The first is that Norway has set out to be a global leader in climate action, yet continued expansion of oil and gas production could eclipse the benefits of Norway’s domestic emission reduction efforts. The second is that climate policies in line with the Paris Agreement could reduce global oil and gas demand, making investments in future production unprofitable. Both of these risks call for closer analysis of what level of fossil fuel production is consistent with global climate targets.

In summary, our analysis finds that: